People Risk Isn’t One Program, It’s an Ecosystem

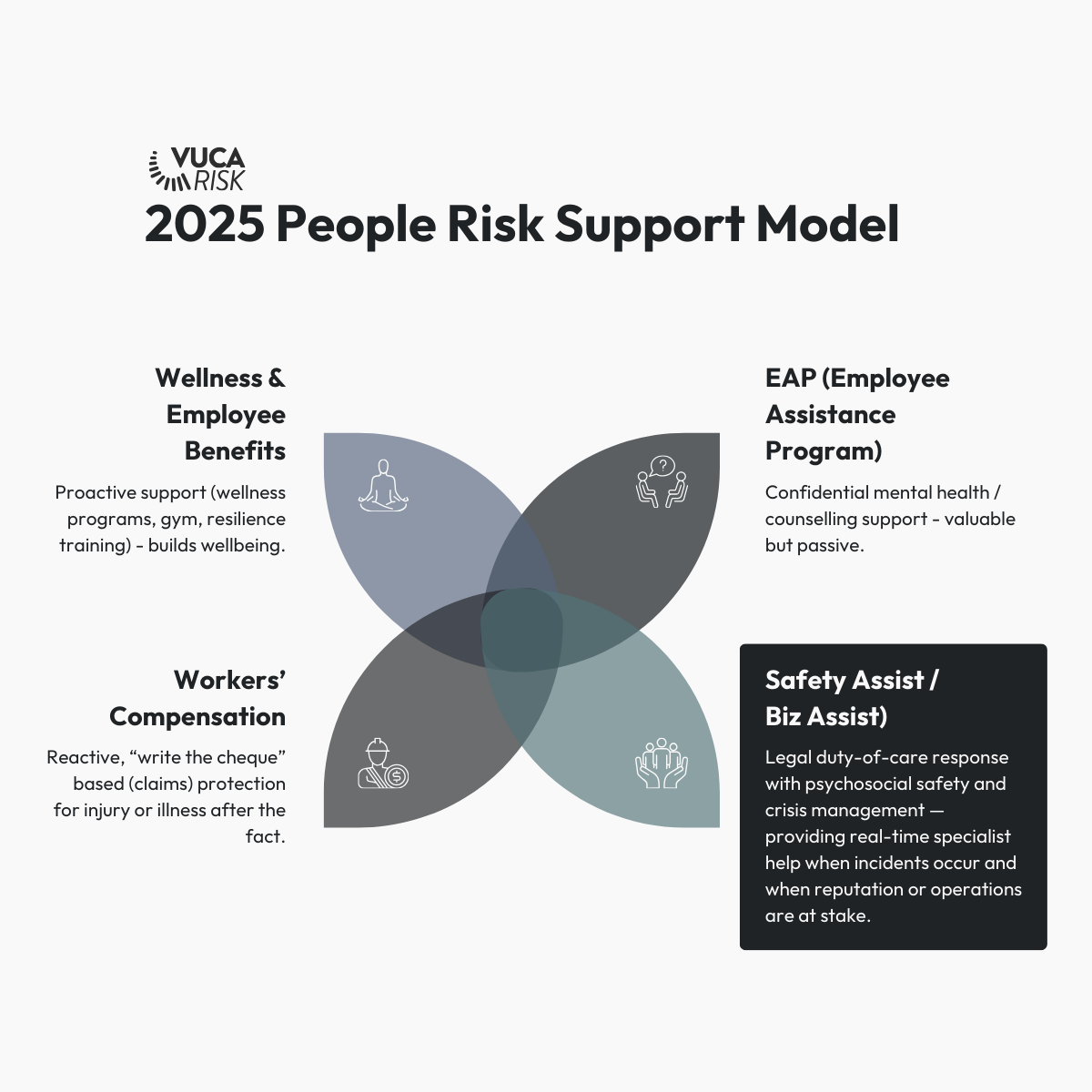

Businesses often think they’re covered when it comes to protecting their people. They have Workers’ Compensation, an EAP, some wellness initiatives, and compliance frameworks in place.

But when a serious psychosocial incident hits - domestic violence spillover, public aggression, workplace harassment, stalking - those supports don’t always activate fast enough, or work together. The result? Confusion, delay, and greater risk for both people and the business.

The Risk Landscape Has Shifted

Psychosocial safety is now a board-level obligation.

Regulators are tightening duties of care. Boards and executives are expected to identify, assess, and control psychosocial hazards, not just offer training or counselling.Claims are rising - and costly.

Serious psychological injury claims have increased 37% since 2017–18, with an average cost of $55,000 per claimand 5× more lost time than physical injuries (Safe Work Australia).Reputation can collapse overnight.

Public and social media reaction often peaks within 48 hours, long before legal or policy mechanisms can respond.

Traditional safety nets were never designed for this. Workers’ Comp is reactive. EAPs are passive. Wellness perks are preventative but can’t handle a crisis.

Introducing a Fourth Layer: VUCA Risk

(Graphic: 2025 People Risk Support Model — showing Workers’ Comp, EAP, Wellness, and VUCA Risk as the fourth layer)

VUCA Risk was built to give brokers and businesses a new layer of protection:

Insurer-backed, real-time response when psychosocial crises hit.

Crisis management, legal and cyber support, emergency accommodation, and communications handling - all activated immediately.

Designed to complement existing programs, not replace them.

This model closes the gap between prevention and reaction, giving boards evidence of due diligence while protecting staff, morale, and brand reputation.

Why Brokers Should Move Now

Trusted brokers stay ahead of emerging risk. Psychosocial safety is not only a compliance obligation, it’s a reputational and operational threat.

Adding psychosocial incident response to your placements gives clients:

Board-level assurance that they’re meeting WHS obligations.

Cost protection against rising psychological injury claims.

Confidence that people and brand are protected in real time.

If your clients haven’t started preparing for psychosocial risk, now is the time to start the conversation.